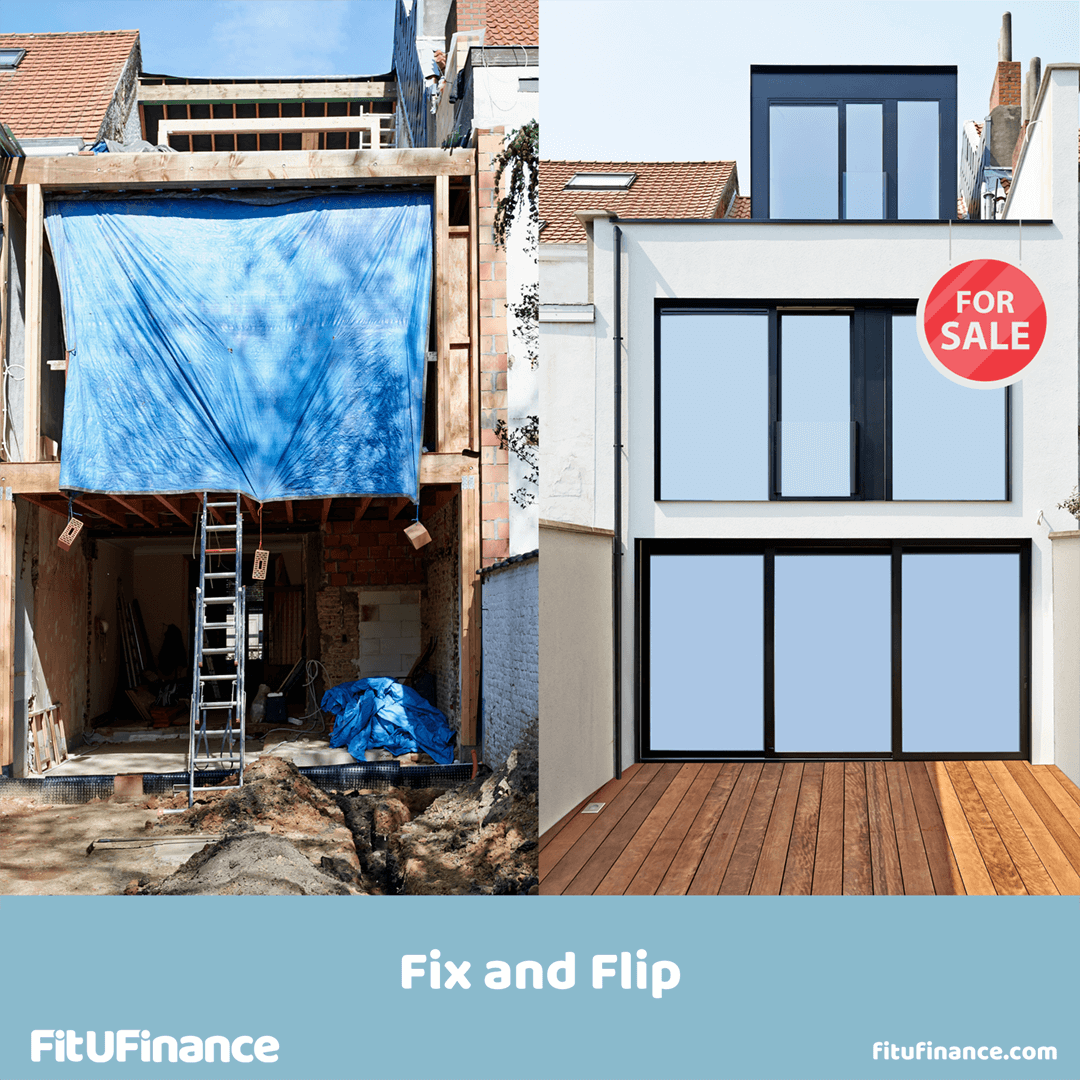

FIX AND FLIP FINANCE OPTIONS

Financing Fix and Flip Investment Properties.

Fix and flip properties can be extremely profitable, but if you don’t get your finance right, you could be in for an unpleasant surprise. Set clear goals, and more significantly, set a clear budget. It goes without saying that you will have done your due diligence on the property in terms of structure and associated restoration costs, but it’s also important to have a clear idea of what you want to spend per month, how long you plan to hold onto the property and, what sort of return you’re expecting.

Plenty of wannabe house flippers fall at the first hurdle, when they can’t answer basic questions about their plan or don’t have the necessary paperwork in place to support the loan request.

There are lots of options for newbie flippers as well as established house developers. There are finance companies who offer up to 85% of the purchase price, as well as financing 100% of the renovation cost. Look for those lenders who are specialists in BRRRR (Buy, Renovate, Rent, Refinance, Repeat) financing as they are likely to look more favorably on your project.

When a loan is based on the value of an investment property, rather than the borrower’s credit, it could mean that those who have had difficulty getting conventional financing–due to foreclosure, or a short sale –can use the value of the asset as collateral. These types of loans work for both those new to property investment and experienced house flippers who are looking to free up liquidity or scale their business for growth.

These loans can be used for both single family dwellings,multi-family and mixed-use buildings. In fact, lenders will look favorably on all these options.

So, what are your options?

A conventional bank loan will look for a successful history of at least two years in renovating properties. Typically,the interest rates from banks will be lower between 3% -4%. Banks will lend to money for flipping if you have an official business, a healthy credit score, and a proven track record of success in similar projects. You may have to wait several months to secure financing from a bank.